change in net working capital cash flow statement

CFO Net Income non-cash expenses increase in non-cash net working capital. If the change in net working capital presents a positive value it means the assets of.

Example Cash Flow From Operating Activities Alphabet Inc Cash Flow Statement Business Valuation Financial Modeling

A change in inventory accounts receivable and accounts payable results in a change in working capital and a cash flow in or out of the business.

. The change in the net working capital over a stated period of time. Preparation of Statement of Changes in Working Capital. Working capital would change as its current asset increases and current liability increases by the same amount as a note payable.

Net Working Capital Current Assets Current Liabilities. How to Calculate the Net Working Capital on Cash Flow. A positive Change in Net Working Capital can be seen as cash outflow.

Step 2 Non-Cash Expenses. Change in Working Capital Summary. To determine the change in net working capital the easiest appraach is just to take the difference between the beginning and ending net working capital NWC figures.

Change in Net Working Capital is calculated using the formula given below. There are a few different methods for calculating net working capital depending on what an analyst wants to include or exclude from the value. At the end of the period assuming no bad debts 753 has been paid leaving a closing debtor balance of 247.

Net Working Capital Current Assets less cash Current Liabilities less debt or. In this case there must be an increase in the cash flow statement. If a transaction decreases a current asset but has no effect on current liability there will be a decrease in working capital and cash flow.

Thus the formula for Cash From Operations CFO is. To learn more launch our financial modeling courses Financial Modeling Courses now. Net Working Capital Accounts Receivable Inventory Accounts Payable.

Net Working Capital Current Assets less cash Current Liabilities less debt Formula 2. Change in Working capital does mean actual change in value year over year ie. The cash that is generated and added to retained earnings.

What is the net change in non-cash working capital that would appear on the cash flow statement given the following. From the working capital example we will first add up the current assets and the current liabilities and then use them to calculate the working capital formula. Net changes in principal capital Change and inventory always in receivables Change in payables Cash generated from operations CASH FLOW STATEMENT.

There would be no change in working capital but operating cash flow would decrease by 3 billion. If the change in NWC is positive the company collects and holds onto cash earlier. 7 rows Once we have all net cash balances for each of the three sections of the cash flow.

Find the amount of a companys current assets and current liabilities on its most recent balance sheet and the previous accounting periods. The cash flow statements informally named changes in working capital section will include some noncurrent assets and liabilities and thus excluded for the textbook definition of working capital as long as they are associated with operations. Conversely selling a fixed asset would boost cash flow and working capital.

Change in Working Capital Cash Flow Statement Operating net working capital can be viewed as the amount of cash tied up in the net funding of inventory accounts receivable and accounts payable. There would be no change in working capital but operating cash flow would decrease by 3 billion. B Cash flow to creditors is defined as.

Net Working Capital Formula. If a company purchased a fixed asset such as a building the companys cash flow would decrease. Imagine if Exxon borrowed an additional 20 billion in long-term debt boosting the current.

The Working capital is the difference between a companys current assets and current liabilities. However if the change in NWC is negative the business model of the company might require spending cash before it can sell. In both the cases an outflow of cash would be involved.

The Change in Net Working Capital NWC section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period. On the Cash Flow Statement the Change in Working Capital is defined as Old Working Capital New Working Capital where Working Capital Current Operational Assets Current Operational Liabilities. Here comes an explanation.

Adjusted for changes in non-cash working capital accounts receivable inventory accounts payable etc. Net Working Capital Current Assets Current Liabilities. Net change in Working Capital 1033 850 183 million cash outflow Analysis of the Changes in Net Working Capital.

Its defined this way on the Cash Flow Statement because Working Capital is a Net Asset and when an Asset increases the company. Changes in working capital are reflected in a firms cash flow statementHow Working Capital Impacts Cash Flow. I Increase in cash of 500ii Increase in accounts receivables of 800ii Decrease in inventories of 350iv Decrease in prepaid expenses of 225v Increase in PPE of 950vi Increase in accounts payable of 400.

It means the change in current assets minus the change in current liabilities. Having a positive cash therefore is transfer because he means became the ball has at. Working capital Current.

A negative Change in Net Working Capital basically shows cash inflow. The change in net working capital formula is given as N E B where E is ending net working capital and B is beginning NWC. The net decrease in working capital or decrease in current assets with an increase in current liabilities or we can say an increase in assets is less than the increase in current liabilities.

A companys working capital is a core component of financing its operations. So the net effect is decreased in cash flow from operating activities. Change in Net Working Capital Net Working Capital for Current Period.

Cash Sheet Templates 15 Free Docs Xlsx Pdf Cash Flow Statement Business Valuation Cash Flow

Free Cash Flow Operating Cash Ratio Free Cash Cash Flow Flow

Iscaccounts Questionpaper2017 Solvedforclass12 Aplustopper Cash Flow Statement Question Paper Previous Year Question Paper

Operating Cash Flow Ocf Cash Flow Statement Cash Flow Budget Calculator

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf Fcff Cash Flow Statement Cash Flow Financial Statement Analysis

Cash Flow From Operating Activities Cash Flow Statement Cash Flow Positive Cash Flow

Cash Flow Formula How To Calculate Cash Flow With Examples Positive Cash Flow Cash Flow Formula

Image Result For Cash Flow Statement Template Contents Cash Flow Statement Financial Statement Analysis Personal Financial Statement

Direct Method Cash Flows Adjustments Review Positive Cash Flow Cash Flow Statement Cash Flow

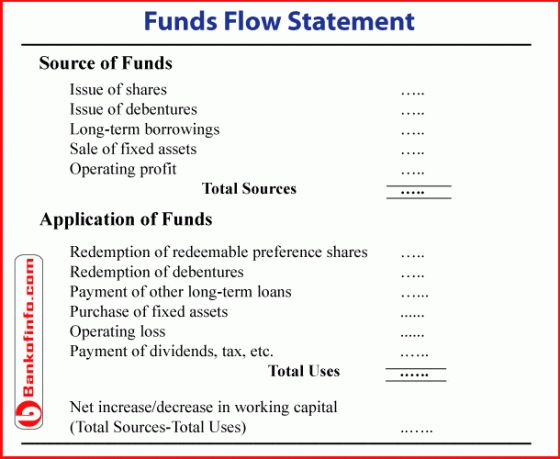

How To Prepare Fund Flow Statement Fund Flow Accounts Receivable

Monthly Cash Flow Forecast Model Guide And Examples Cash Flow Cash Flow Statement Financial Modeling

Free Cash Flow Cash Flow Cash Flow Statement Free Cash

Operating Cash Flow Ocf Cash Flow Statement Positive Cash Flow Cash Flow

Net Cash Change In Cash Flow Statement Should Tie To Cash Reported In The Balance Sheet Cash Flow Statement Cash Flow Balance Sheet

How To Prepare Fund Flow Statement Fund Cash Funds Flow

Iscaccounts Questionpaper2017 Solvedforclass12 Aplustopper Cash Flow Statement Question Paper Previous Year Question Paper

Cash Flow Formula How To Calculate Cash Flow With Examples Positive Cash Flow Cash Flow Formula

Free Cash Flow Cash Flow Cash Flow Statement Free Cash

Cash Flow From Operating Activities 2 3 Cash Flow Statement Cash Flow Cash