bear trap stock example

Bear traps can be a bit harder to spot in the crypto chart patterns than in the stock market. One such trap is the Bear Trap in Stocks.

What Is A Bear Trap On The Stock Market Fx Leaders

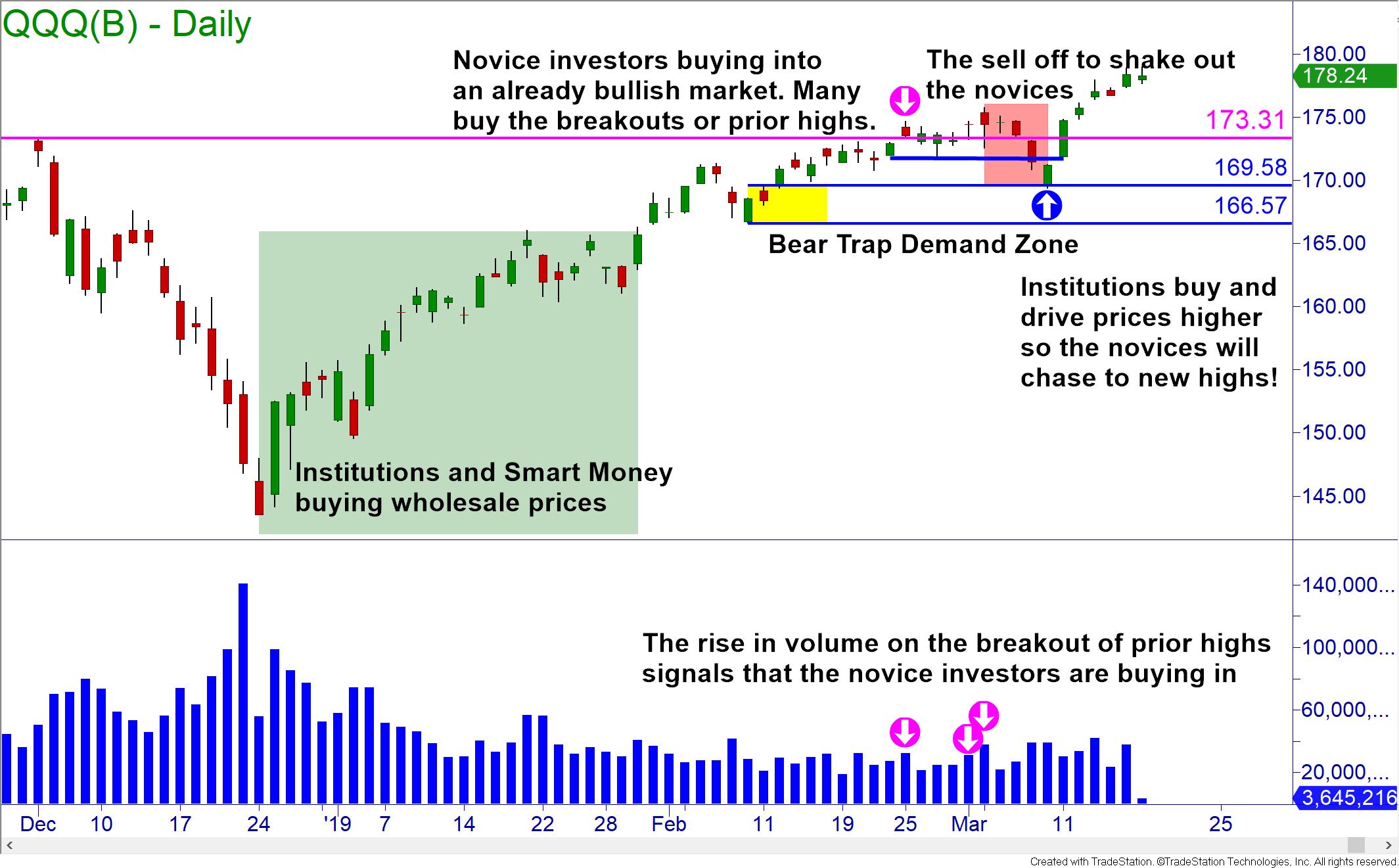

Example of a bear trap pattern.

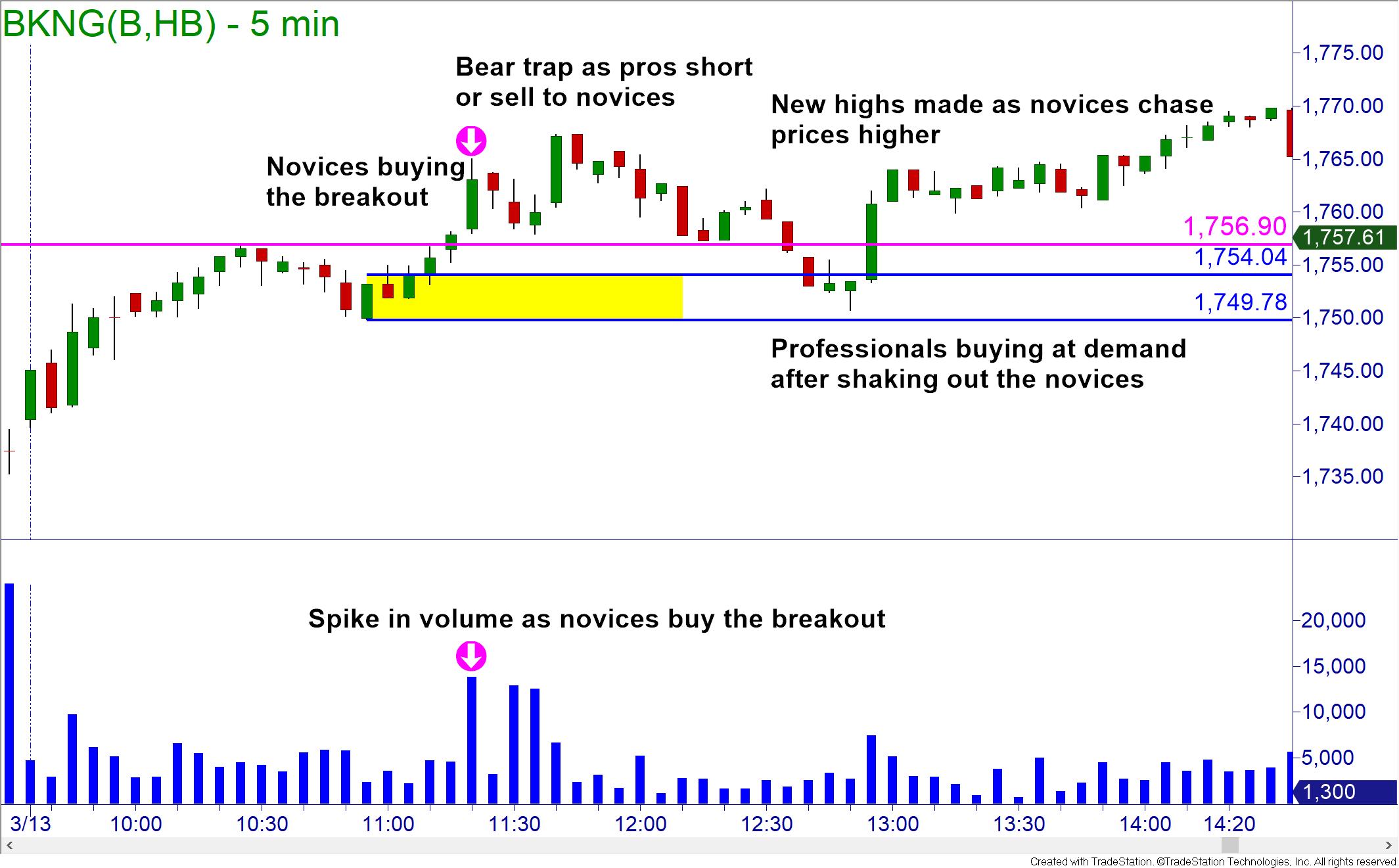

. Ad Invest in growing companies solving sustainable challenges. Example of trading the bear trap pattern. Bear Trap Stock Chart Example.

In the next example we can see a bear trap pattern. Bounce which will often precede the short-term top in the. For example intraday in forex markets or over several trading periods in the stock market.

Bear Trap Chart Example. A bear trap is a trading term used to describe market situations that indicate a downturn in prices but actually leads to higher prices. Have you ever noticed price will often move just above or just below a key support or.

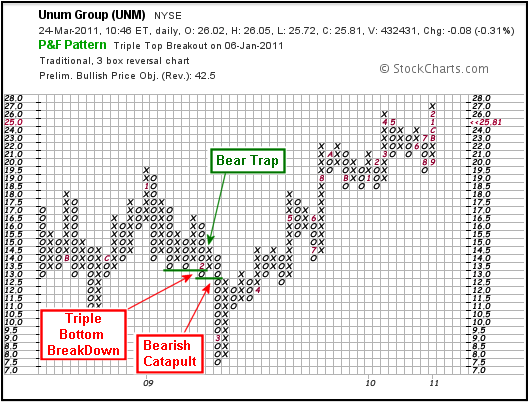

The chart below is for the agricultural products and services retailer Agrium Inc. This is the prime example of a bear trap in financial markets. These sentiment swings can happen over various time periods.

Bear Trap Example Chart and Pattern. Markets rarely make v-shaped. Below is an example of a bear trap on 76 for the stock.

For a bear trap chart example consider a scenario where traders were watching a key support level of 425 on the SPDR SP 500 ETF a. Notice from this chart that. In general a bear trap is a technical.

A bull trap is a false signal referring to a declining trend in a stock index or other security that reverses after a convincing rally and breaks a prior support level. 1 day agoBeware the Bear Trap Disguised as a Stock Rally. Bear Trap into a.

Here price action moves sideways after a steady. A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively. Rising stock prices cause losses for bearish investors who are now trapped.

Bearish Candlestick Closing Above Support. Bear Trap Chart 2. What is a Bear Trap.

Markets rarely make v-shaped. Bear traps occur when investors bet on a stocks price to fall but it rises instead. Bloomberg Opinion -- There are many ways to lose money in down markets and buying fleeting rebounds is among the best.

The bear and bull trap are created by the major market players. For example when there are a lot of people. With no central governing body institutions.

This causes traders to open short positions. After the support is put in place just below. Bull Trap vs Bear Trap Explained.

Here is an example. 3 Types of Candlesticks in Bear Traps 1. It is a false indication of a reversal from an uptrend into a downtrend.

Illustrated below is another bear trap example with a stock. Markets move higher because of an imbalance between buying and selling pressure. A Bear Trap is a technical pattern that occurs when the performance of a stock or an index incorrectly signals a reversal of a rising price trend.

A Bear Trap is a technical pattern that occurs when the performance of a stock or an index incorrectly signals a reversal of a rising price trend. A bear trap is the opposite of a bull trap. Seek companies with potential for sustainable business practices and positive impact.

A Bullish Bear Trap Candlestick Breaks The Support Level and Goes Down But Eventually Closes Above The Support Line Forming A Bullish Candlestick.

Don T Get Caught In A Bull Trap Tips To Avoid Getti Ticker Tape

The Great Bear Trap Bull Trap Seeking Alpha

What Is A Bear Trap On The Stock Market

Bear Trap Explained For Beginners Warrior Trading

P F Bull Bear Traps Chartschool

Bear Trap Stock Trading Definition Example How It Works

3 Bear Trap Chart Patterns You Don T Know

Bear Trap Explained For Beginners Warrior Trading

Bear Trap Best Strategies To Profit From Short Squeezes

What Is A Bear Trap Seeking Alpha

What Is A Bear Trap On The Stock Market Fx Leaders

What Is A Bear Trap On The Stock Market

Bear Trap Best Strategies To Profit From Short Squeezes

What Is A Bear Trap On The Stock Market Fx Leaders

What Is A Bull Trap In Trading And How To Avoid It Ig En

Bear Trap Best Strategies To Profit From Short Squeezes

What Is A Bear Trap On The Stock Market Fx Leaders

Bull Traps Vs Bear Traps How To Trade With Them Phemex Academy